Expansionary fiscal policy increases the level of aggregate demand, through either increases in government spending or reductions in taxes. Expansionary policy can do this by (1) increasing consumption by raising disposable income through cuts in personal income taxes or payroll taxes; (2) increasing investments by raising after-tax profits through cuts in business taxes; and (3) increasing government purchases through increased spending by the federal government on final goods and services and raising federal grants to state and local governments to increase their expenditures on final goods and services. Contractionary fiscal policy does the reverse: it decreases the level of aggregate demand by decreasing consumption, decreasing investments, and decreasing government spending, either through cuts in government spending or increases in taxes. The aggregate demand/aggregate supply model is useful in judging whether expansionary or contractionary fiscal policy is appropriate.

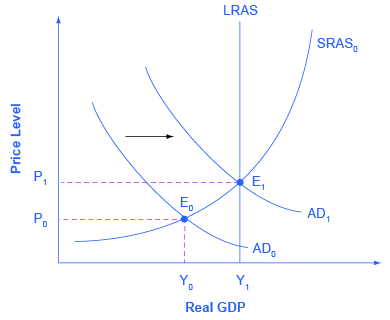

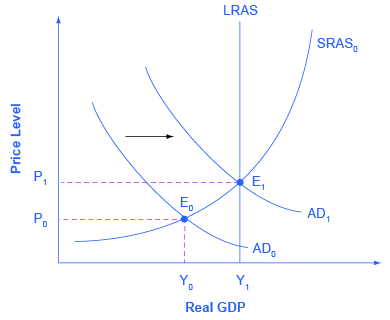

Consider first the situation in Figure 2, which is similar to the U.S. economy during the recession in 2008–2009. The intersection of aggregate demand (AD0) and aggregate supply (SRAS0) is occurring below the level of potential GDP as indicated by the LRAS curve. At the equilibrium (E0), a recession occurs and unemployment rises. In this case, expansionary fiscal policy using tax cuts or increases in government spending can shift aggregate demand to AD1, closer to the full-employment level of output. In addition, the price level would rise back to the level P1 associated with potential GDP.

Should the government use tax cuts or spending increases, or a mix of the two, to carry out expansionary fiscal policy? After the Great Recession of 2008–2009 (which started, actually, in very late 2007), U.S. government spending rose from 19.6% of GDP in 2007 to 24.6% in 2009, while tax revenues declined from 18.5% of GDP in 2007 to 14.8% in 2009. The choice between whether to use tax or spending tools often has a political tinge. As a general statement, conservatives and Republicans prefer to see expansionary fiscal policy carried out by tax cuts, while liberals and Democrats prefer that expansionary fiscal policy be implemented through spending increases. The Obama administration and Congress passed an $830 billion expansionary policy in early 2009 involving both tax cuts and increases in government spending, according to the Congressional Budget Office. However, state and local governments, whose budgets were also hard hit by the recession, began cutting their spending—a policy that offset federal expansionary policy.

The conflict over which policy tool to use can be frustrating to those who want to categorize economics as “liberal” or “conservative,” or who want to use economic models to argue against their political opponents. But the AD–AS model can be used both by advocates of smaller government, who seek to reduce taxes and government spending, and by advocates of bigger government, who seek to raise taxes and government spending. Economic studies of specific taxing and spending programs can help to inform decisions about whether taxes or spending should be changed, and in what ways. Ultimately, decisions about whether to use tax or spending mechanisms to implement macroeconomic policy is, in part, a political decision rather than a purely economic one.

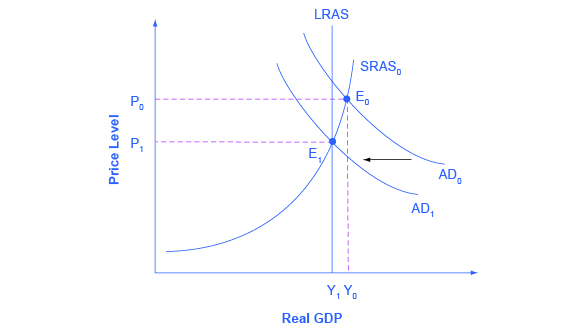

Fiscal policy can also contribute to pushing aggregate demand beyond potential GDP in a way that leads to inflation. As shown in Figure 3, a very large budget deficit pushes up aggregate demand, so that the intersection of aggregate demand (AD0) and aggregate supply (SRAS0) occurs at equilibrium E0, which is an output level above potential GDP. This is sometimes known as an “overheating economy” where demand is so high that there is upward pressure on wages and prices, causing inflation. In this situation, contractionary fiscal policy involving federal spending cuts or tax increases can help to reduce the upward pressure on the price level by shifting aggregate demand to the left, to AD1, and causing the new equilibrium E1 to be at potential GDP, where aggregate demand intersects the LRAS curve.

Again, the AD–AS model does not dictate how this contractionary fiscal policy is to be carried out. Some may prefer spending cuts; others may prefer tax increases; still others may say that it depends on the specific situation. The model only argues that, in this situation, aggregate demand needs to be reduced.

Expansionary fiscal policy increases the level of aggregate demand, either through increases in government spending or through reductions in taxes. Expansionary fiscal policy is most appropriate when an economy is in recession and producing below its potential GDP. Contractionary fiscal policy decreases the level of aggregate demand, either through cuts in government spending or increases in taxes. Contractionary fiscal policy is most appropriate when an economy is producing above its potential GDP.